Assurance emprunteur : vers une date unique pour la résiliation en 2019

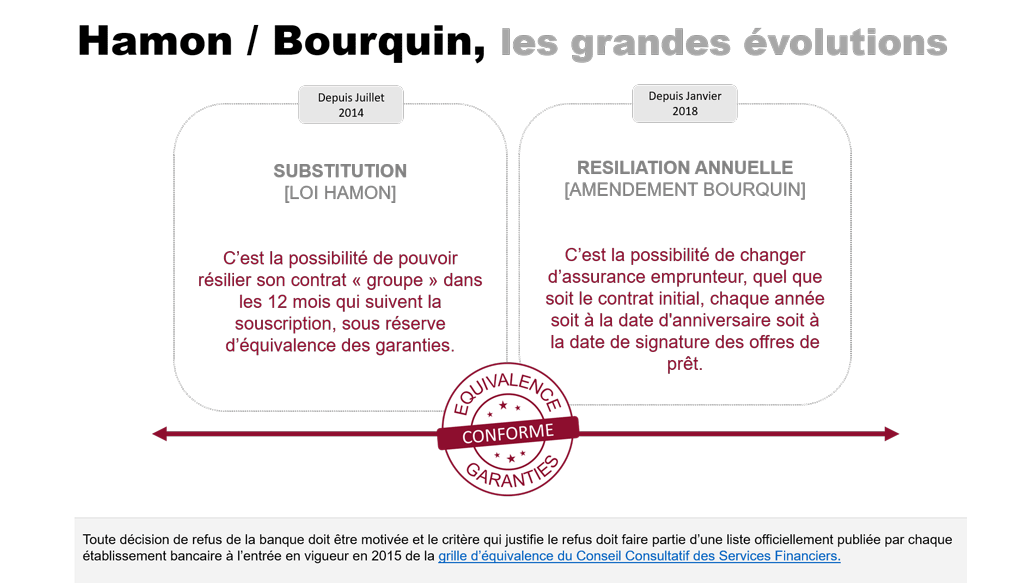

La récente mise en application du second volet de l’amendement Bourquin vient renforcer le droit à la renégociation annuelle du contrat d’assurance emprunteur.

by Véronique Tankoua, Legal Counsel at Digital Insure

This marks the end of an ambiguity that banks had skillfully maintained until now. Since the Bourquin amendment, which came into force on January 1, 2018, borrowers can change their home loan insurance contract annually, on its anniversary date, provided they give two months’ notice. But on which anniversary date?

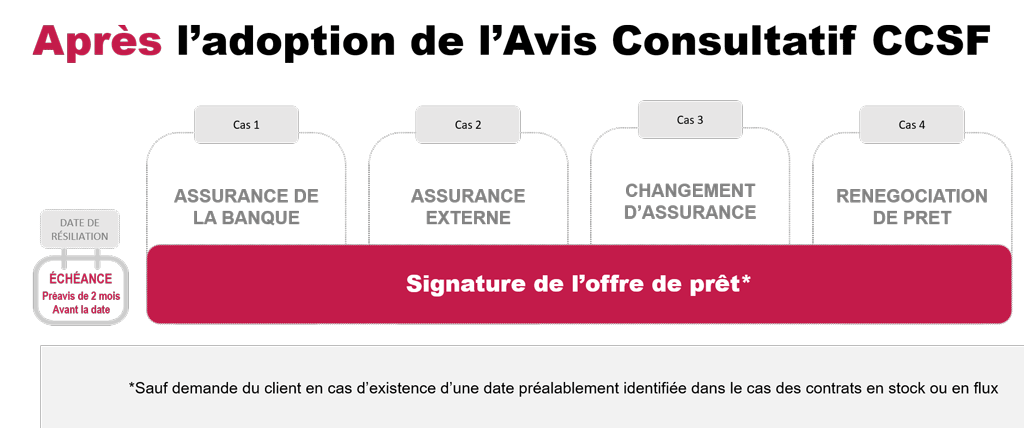

The law did not specify any reference date. Consequently, the choice was left to the arbitrary discretion of the banks, who exploited this ambiguity to prevent their clients from easily changing insurers. Following a proposal from the FFA (French Insurance Federation), the CCSF, a consultative body comprising banks, insurance companies, mortgage brokers, and consumer associations, met on Tuesday, November 27, 2018, to decide: The anniversary date of the loan offer’s signature will now serve as the reference for all contracts, both existing and future. To allow all institutions time to update their information systems, this harmonization measure, adopted unanimously, will be effective no later than the second half of 2019.

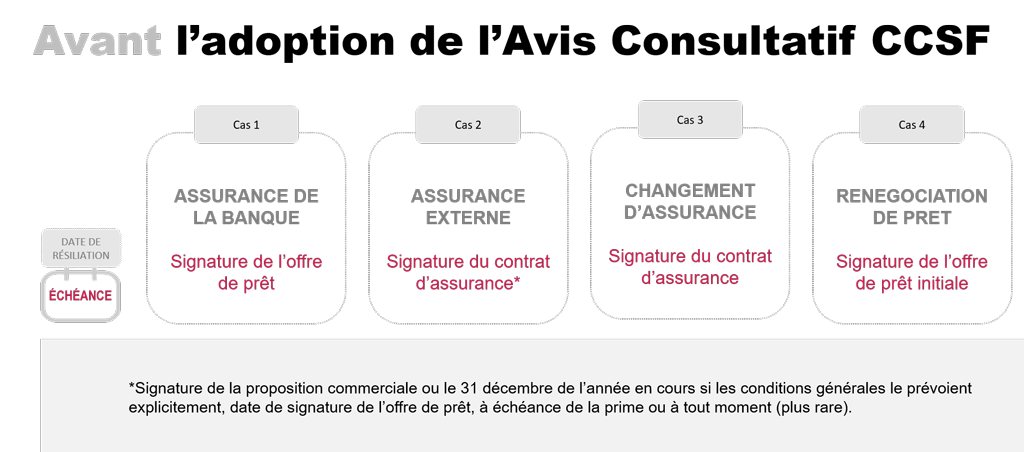

Currently, some banks already use the loan offer signature date (Banque Postale, BNP, Caisse d’Epargne). However, others still consider the date of issuance of the home loan offer (Banque Populaire), the effective date of the insurance contract, which corresponds to the date of the first insurance premium payment (CIC, Crédit Mutuel), or even the signature date of the insurance contract application (Crédit Agricole).

This program, intended for innovative companies less than 15 years old, should enable Digital Insure to receive significant support for its growth.

This ambiguity maintained by the banks is clearly not in the consumer’s interest, as poorly informed consumers often miss out on the benefits of the new law. Furthermore, it is also necessary to clearly define the scope of the text, which outlines two distinct scenarios:

The CCSF’s opinion of 2018-11-27 is intended to apply to all insurance contracts (group insurance or external delegation). However, a subtlety remains. Indeed, if the current insurance contract does not specify any maturity date contractually and explicitly agreed upon between the parties, then no choice is left to the borrower. Consequently, only the anniversary date of the loan offer’s signature serves as the maturity date.

Conversely, if a maturity date has been explicitly and contractually agreed upon between the parties, then the Opinion allows the borrower to choose between the anniversary date of the loan offer’s signature or the date contractually agreed upon between the parties. However, the borrower must request that the contractually agreed-upon date be applied. If the borrower does not make such a request, the anniversary date of the loan offer’s signature by the borrower will apply by default.

Exemples de cas pratiques :

Digital Insure a créé des offres sur mesure au parcours Hamon / Bourquin

Tailored offers, adapted to cancellation constraints, through a 100% digital process, allow for the issuance of an insurance certificate in less than 30 minutes.

If your daily activities do not always allow you to process all your commercial opportunities, our team of expert tele-advisors can handle everything on your behalf, providing commercial support to your clients and prospects in subscribing to their borrower insurance contract.

Pour aller plus loin

The Bourquin Amendment offers a new opportunity for borrowers to utilize the insurance delegation mechanism. It allows for the cancellation of the loan insurance contract at its maturity, or rather, on its ‘anniversary date’.

The cancellation period must be 2 months before the contract’s maturity date. However, Article L.113-12 of the Insurance Code does not specify which date should be considered the maturity date. Given this legal silence, a legal ambiguity persists for borrowers, as not all insurers refer to the same maturity date to set the annual cancellation date for borrower insurance.

A recent decision by the CCSF (Financial Sector Consultative Committee), issued on 2018-11-27, has standardized this date for all insurance stakeholders. This will be effective for all institutions starting from the second half of 2019.

The annual cancellation of credit insurance must comply with substantive and formal conditions. Among the former is the requirement for two months’ notice before the maturity date. However, the legislator provides no further details on the date to be considered the contract’s maturity. This has resulted in a “non-uniform determination of the maturity date” by insurance organizations. This legal ambiguity has been widely criticized by consumer associations and recently denounced by the ACPR (Prudential Control and Resolution Authority) of the Banque de France in the November 2018 issue of the monthly review published by this body. The latter revealed the existence of various practices aimed at making borrowers’ procedures more complex or postponing the cancellation date when they expressed their desire to substitute their insurance contract for a new, more attractive one. For example, “the choice of an uncertain annual maturity date for the insurance contract and unsatisfactory communication methods for the borrower.”

Specifically, some insurers chose the anniversary date of the loan offer’s signature as the annual cancellation date for borrower insurance, others opted for the date of issuance of the loan offer, and still others for the date of the first monthly payment, etc.

Harmonization in favor of the loan offer signature date: The CCSF’s Opinion of November 27, 2018, on borrower insurance, partly addresses the annual maturity date of these contracts. It announces “the adoption of a single date” that will be mandatory for all insurers and other concerned professionals starting from the second half of 2019. The chosen date will be “the anniversary of the loan offer’s signature by the borrower, unless the client requests otherwise in the event of a previously identified date for existing or new contracts.” This choice is justified by the CCSF for necessary harmonization with the date adopted by the Consumer Code for exercising the right of substitution implemented in the first year by the Hamon Law.