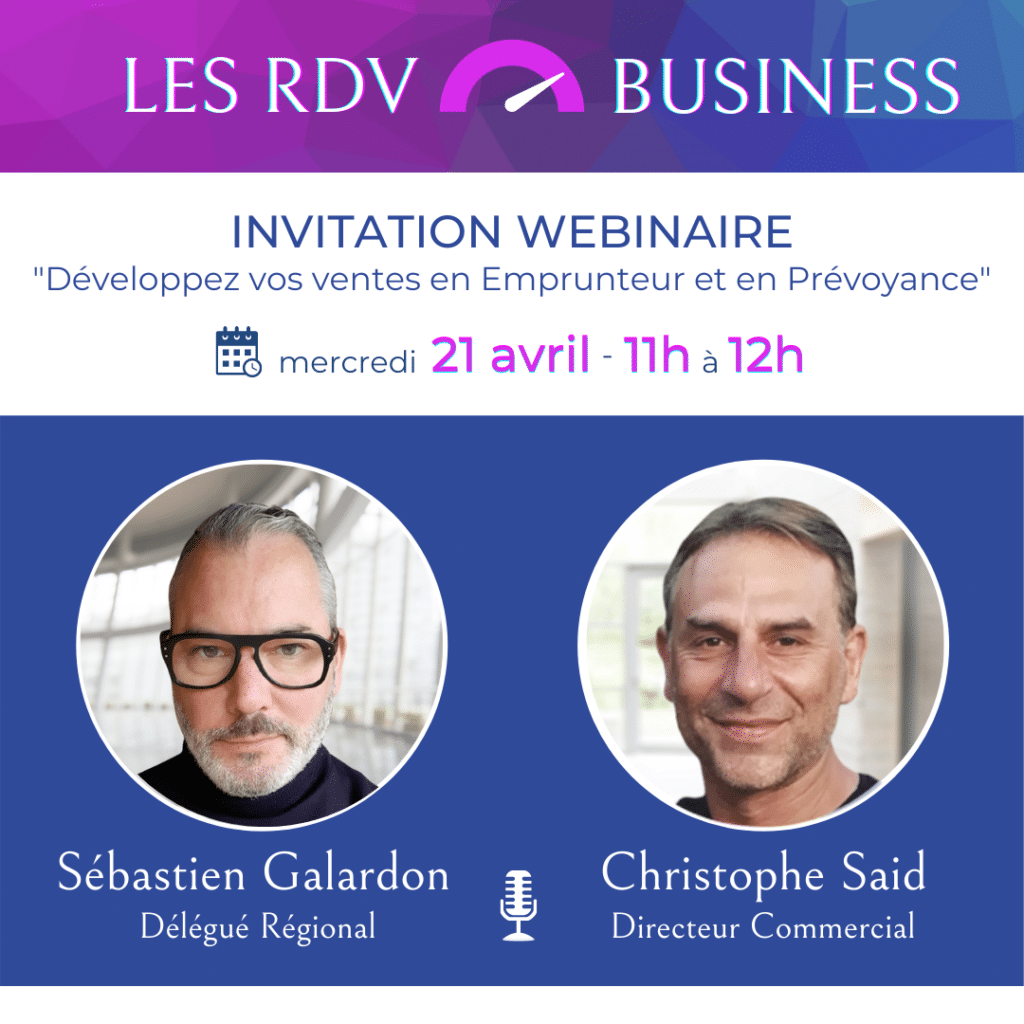

These webinars are consistently co-hosted by Digital Insure’s national and regional experts, and are intended for insurance brokers and credit brokers.

Fully booked? We invite you to join us in May. The next BUSINESS Meeting is already in preparation.

In Borrower Insurance

In Individual Provident Insurance

During this webinar, Digital Insure will introduce its Expert Division and its tailored solutions to cover your VIP clients or those with special risks in Loan Insurance and Protection.

Necessary cookies are absolutely essential for the website to function properly. These cookies ensure basic functionalities and security features of the website, anonymously.

| Cookie | Duration | Description |

|---|---|---|

| viewed_cookie_policy | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether the user has consented to the use of cookies. It does not store any personal data. |

Other unclassified cookies are those that are currently being analyzed and have not yet been classified into a category.

| Cookie | Duration | Description |

|---|---|---|

| CONSENT | No description | |

| Fpestid | No description | |

| st_samesite | No description |

Advertising cookies are used to provide visitors with relevant advertisements and marketing campaigns. These cookies track visitors across websites and collect information to deliver personalized ads.

| Cookie | Duration | Description |

|---|---|---|

| IDE | Used by Google DoubleClick, this stores information on how the user interacts with the website and any advertising prior to visiting the site. This is used to present users with relevant advertisements based on their profile. | |

| test_cookie | This cookie is set by doubleclick.net. The purpose of the cookie is to determine if the user's browser supports cookies. | |

| VISITOR_INFO1_LIVE | This cookie is set by Youtube. Used to track information about embedded YouTube videos on a website. |

Analytical cookies are used to understand how visitors interact with the website. These cookies help provide information on metrics such as the number of visitors, bounce rate, traffic source, etc.

| Cookie | Duration | Description |

|---|---|---|

| __stid | The cookie is set by ShareThis. The cookie is used for site analytics to determine the pages visited, the amount of time spent, etc. | |

| _ga | This cookie is installed by Google Analytics. The cookie is used to calculate visitor, session, and campaign data and to track site usage for the site's analytics report. Cookies store information anonymously and assign a randomly generated number to identify unique visitors. | |

| _gid | This cookie is installed by Google Analytics. The cookie is used to store information about how visitors use a website and helps create an analytics report on how the website is performing. The collected data includes the number of visitors, their origin, and the pages viewed anonymously. |

Functional cookies help to perform certain functionalities such as sharing website content on social media platforms, collecting feedback, and other third-party features.

| Cookie | Duration | Description |

|---|---|---|

| __sharethis_cookie_test__ | This cookie is set by ShareThis to test if the browser accepts cookies. | |

| __stidv | This cookie is used by ShareThis. It is used to share website content to social networks. |

Performance cookies are used to understand and analyze the website's key performance indicators, which helps deliver a better user experience for visitors.

| Cookie | Duration | Description |

|---|---|---|

| _gat | These cookies are installed by Google Universal Analytics to throttle the request rate and limit data collection on high-traffic sites. | |

| YSC | These cookies are set by YouTube and are used to track views of embedded videos. |